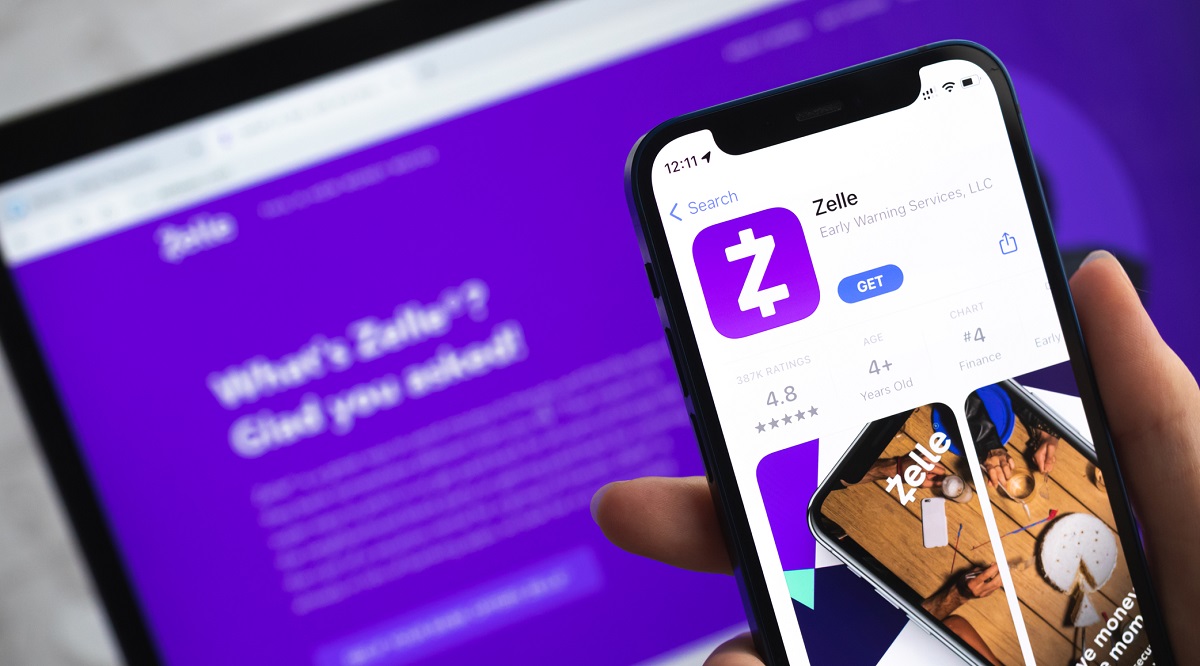

Zelle Bank Transfer Method – Full Method For Noobs

The way we transfer money has evolved significantly with the advancement of technology. One such method that has gained popularity in recent years is the Zelle bank transfer method. In this article, we will explore how Zelle works, its advantages over other payment methods, security measures in place, common use cases, limits and restrictions, troubleshooting, and future developments.

How Does Zelle Work?

Setting up Zelle

To start using Zelle, you need to have a bank account with a participating financial institution. Most major banks and credit unions in the United States offer Zelle as a payment option. Additionally, you will need a valid email address or phone number associated with your bank account.

Linking your bank account

Once you have set up your Zelle account, you can link it to your bank account. This step usually involves verifying your account details and providing authorization for Zelle to access your funds when necessary. The linking process may vary slightly depending on your bank.

Sending money with Zelle

To send money using Zelle, you simply need the recipient’s email address or phone number associated with their Zelle account. After entering the required information, you can specify the amount you wish to send. Zelle facilitates instant transfers between participating banks, making it a convenient option for quick payments.

Advantages of Using Zelle

Instant transfers

One of the significant advantages of using Zelle is the speed of transactions. Unlike traditional bank transfers that can take several business days to complete, Zelle transfers are typically processed instantly. This feature makes Zelle an excellent choice for time-sensitive payments.

Wide availability

Zelle’s widespread availability is another advantage. Many major banks and credit unions in the United States have integrated Zelle into their online banking platforms. This means that if you have an account with a participating institution, you can easily access and use Zelle without the need for additional apps or services.

No additional fees

Using Zelle for money transfers usually does not incur additional fees. While some banks may have their own policies regarding fees, Zelle itself does not charge users for sending or receiving money. This cost-effective nature of Zelle makes it an appealing option for individuals and businesses alike.

Security Measures in Zelle

Zelle takes security seriously and implements various measures to protect its users’ financial information and transactions.

Authentication process

When setting up Zelle, users are required to provide their banking credentials and go through an authentication process. This helps ensure that only authorized individuals can access and use the service. Additionally, Zelle uses multi-factor authentication to provide an extra layer of security.

Encryption and data protection

To safeguard sensitive information, Zelle employs encryption techniques. Encryption helps protect data during transmission, making it difficult for unauthorized parties to intercept and access the information.

Fraud prevention

Zelle has implemented measures to mitigate the risk of fraudulent activities. These measures include monitoring transactions for suspicious behavior, implementing transaction limits, and providing guidelines to users on how to recognize and avoid scams. However, it is still essential for users to exercise caution and be vigilant while conducting transactions.

Zelle vs. Other Payment Methods

Comparison with traditional bank transfers

Compared to traditional bank transfers, Zelle offers several advantages. While bank transfers often take time to process, Zelle transactions are typically completed instantly. Zelle also eliminates the need for providing lengthy account numbers and routing information, as all you need is the recipient’s email address or phone number.

Contrasting with third-party apps like Venmo

Zelle is often compared to popular third-party payment apps like Venmo. While both offer convenient ways to send money, there are some key differences. Zelle is directly integrated with participating banks’ online platforms, allowing users to access the service without the need for additional apps. Venmo, on the other hand, is a standalone app that requires users to create an account and link it to their bank account or credit card.

Common Uses of Zelle

Zelle’s versatility makes it suitable for various financial transactions. Some common use cases of Zelle include:

Splitting bills with friends

Whether it’s a group dinner or shared expenses for a trip, Zelle allows you to split bills with friends seamlessly. Instead of dealing with cash or checks, you can use Zelle to transfer money directly to your friends’ accounts.

Paying rent and utilities

Zelle is a convenient method for paying rent and utility bills. Instead of writing and mailing checks or making cash payments, you can use Zelle to send money to your landlord or service provider instantly.

Purchasing goods and services

Zelle can also be used for making purchases. Many businesses now accept Zelle as a payment option, enabling customers to complete transactions quickly and securely.

Zelle Limits and Restrictions

While Zelle offers convenience, it is important to be aware of its limits and restrictions.

Transaction limits

Zelle imposes transaction limits to prevent abuse and potential fraud. The exact limits may vary depending on the user’s bank and account type. It is advisable to check with your bank for specific information regarding transaction limits.

Eligible banks and credit unions

While Zelle is available with many major banks and credit unions, not all financial institutions offer this service. It is crucial to confirm whether your bank supports Zelle before attempting to use it.

Availability in international transfers

Zelle is primarily designed for domestic transactions within the United States. As of now, international transfers are not supported through Zelle. If you need to send money internationally, it is recommended to explore other available options.

Troubleshooting and Support

Despite Zelle’s user-friendly interface, users may encounter issues from time to time. Here are some common problems and their solutions:

Common issues and solutions

-

Transaction not received: If the recipient claims not to have received the funds, double-check the email address or phone number used. If the information is correct, contact Zelle customer support for assistance.

-

Invalid credentials: If you are having trouble logging in or linking your bank account, ensure that you are entering the correct credentials. If the problem persists, contact your bank or the Zelle support team.

Contacting Zelle customer support

If you need additional assistance or encounter an issue that is not addressed in the FAQs, you can contact Zelle customer support. The contact information can usually be found on the official website of your bank or on the Zelle website.

Future Developments and Expansion

Zelle continues to expand its reach and forge partnerships with various financial institutions. These collaborations aim to enhance the accessibility and usability of the Zelle platform. Additionally, there is an ongoing exploration of integrating Zelle with new platforms and services, which may further broaden its capabilities and user base. Zelle Bank Transfer

Conclusion

Zelle provides a convenient and secure method for transferring money between individuals and businesses. With its instant transfers, wide availability, and absence of additional fees, Zelle has become a popular choice for many users. The implementation of security measures and the ability to perform various financial transactions make Zelle a versatile tool in today’s digital banking landscape.

FAQs

-

Can I use Zelle if my bank doesn’t offer it? Zelle requires participation from your bank or credit union. If your financial institution doesn’t offer Zelle, you won’t be able to use the service. However, you can check if there are alternative payment methods available through your bank.

-

Is Zelle available internationally? Currently, Zelle primarily supports domestic transactions within the United States. International transfers are not available through Zelle. If you need to send money internationally, consider exploring other options such as wire transfers or international payment platforms.

-

Are there any fees for using Zelle? Zelle itself does not charge fees for sending or receiving money. However, individual banks may have their own policies regarding fees. It is recommended to check with your bank for any applicable fees.

-

What should I do if I encounter an issue with a Zelle transaction? If you encounter any issues with a Zelle transaction, such as funds not being received or problems with authentication, it is advisable to first double-check the recipient’s information and your own credentials. If the problem persists, contact Zelle customer support or your bank for assistance.

-

Can I use Zelle for business transactions? While Zelle is primarily designed for individual transactions, some businesses may accept Zelle as a payment option. It is recommended to check with the specific business to confirm their accepted payment methods.

Henceforth, WE WISH TO ANNOUNCE THAT OUR SERVICES ARE NOT AVAILABLE TO PEOPLE FROM NIGERIA AND INDIA. THESE ARE USELESS TIME WASTERS AND THIEVES TRYING TO BEG OR SCAM US OF OUR PRODUCTS. OUR SERVICES ARE NOT FREE AND PAYMENT IS UPFRONT

A LOT OF FOOLS FROM NIGERIA AND INDIA. on the off chance that YOU DON’T TRUST TO USE OUR SERVICES, DON’T CONTACT US AS WE HAVE NO FREE SERVICE

CONTACT US FOR PURCHASES/INQUIRIES, WE RESPOND ALMOST INSTANTLY

HI BUYERS, WE ARE A PROFESSIONAL CARDING AND HACKING TEAM. HOVATOOLS HAS BEEN AROUND SINCE THE TIME OF EVO MARKET, ALPHABAY, WALLSTREET MARKET AND MORE. WE REMAIN STRONG AND RELIABLE IN THE INDUSTRY, ALWAYS PROVIDING YOU WITH THE BEST QUALITY TOOLS TO HELP YOU MAKE MONEY AND MAXIMIZE PROFIT IN THE FRAUD GAME.

TO GET STARTED, YOU CAN VISIT OUR ONLINE SHOP/STORE TO BUY EVERYTHING YOU NEED TO START CASHING OUT. AT THE SHOP YOU GET Accounts & Bank Drops CVV & CARDS DUMPS PERSONAL INFORMATION & SCAN.

BANK HACKING SOFTWARE – WIRE/ACH DARKWEB MONEY TRANSFER HACKERS

Buy Fresh Credit Cards for Carding, BIN LIST Buy Bank Login, RDP, Buy Hacked Paypal accounts. Contact us to buy all tools and carding software. CLICK HERE TO VISIT OUR SHOP

Buy Socks 5, Email Leads, Buy Latest CC to Bitcoin Cashout Guide, Buy Hacked Zelle transfer , Western Union Money Transfer Hack, Buy Hacked Money Transfer service to your bank account.

Enroll for Paid private Carding Class.

![Read more about the article New Amazon Giftcard Checker Proxyless [No Program Needed]](https://hovatools.com/wp-content/uploads/2020/11/hovatool-post-image-57-300x225.jpg)